Understanding Your Property Tax Bill

Learn more about your property tax, including five key takeaways about your bill.

Property Tax Bill Takeaways

- There are seven tax districts/entities included on property tax statements.

- Boone County Fiscal Court only sets the Boone County property tax rate.

- The Boone County Fiscal Court recently voted to lower the County tax rate for 2023.

- The Boone County Property Value Administrator (PVA), a state office, is required by law to assess property value at a fair market rate and to re-assess every three years.

- There are two items to consider that affect your property tax bill amount: 1) Assessment value by the PVA. 2) Tax rates set by each independent taxing entity.

Tax Rates on Your Bill

There are seven tax descriptions on every property tax bill. Property owners in incorporated cities (Florence, Union, Walton) pay a city property tax as well. Property owners with an occupied dwelling also pay a flat rate 911 fee. This funds the 911 system that provides emergency response service and replaces the landline fee that was once assessed per telephone line. The 911 service is restricted by law to only fund 911 services.

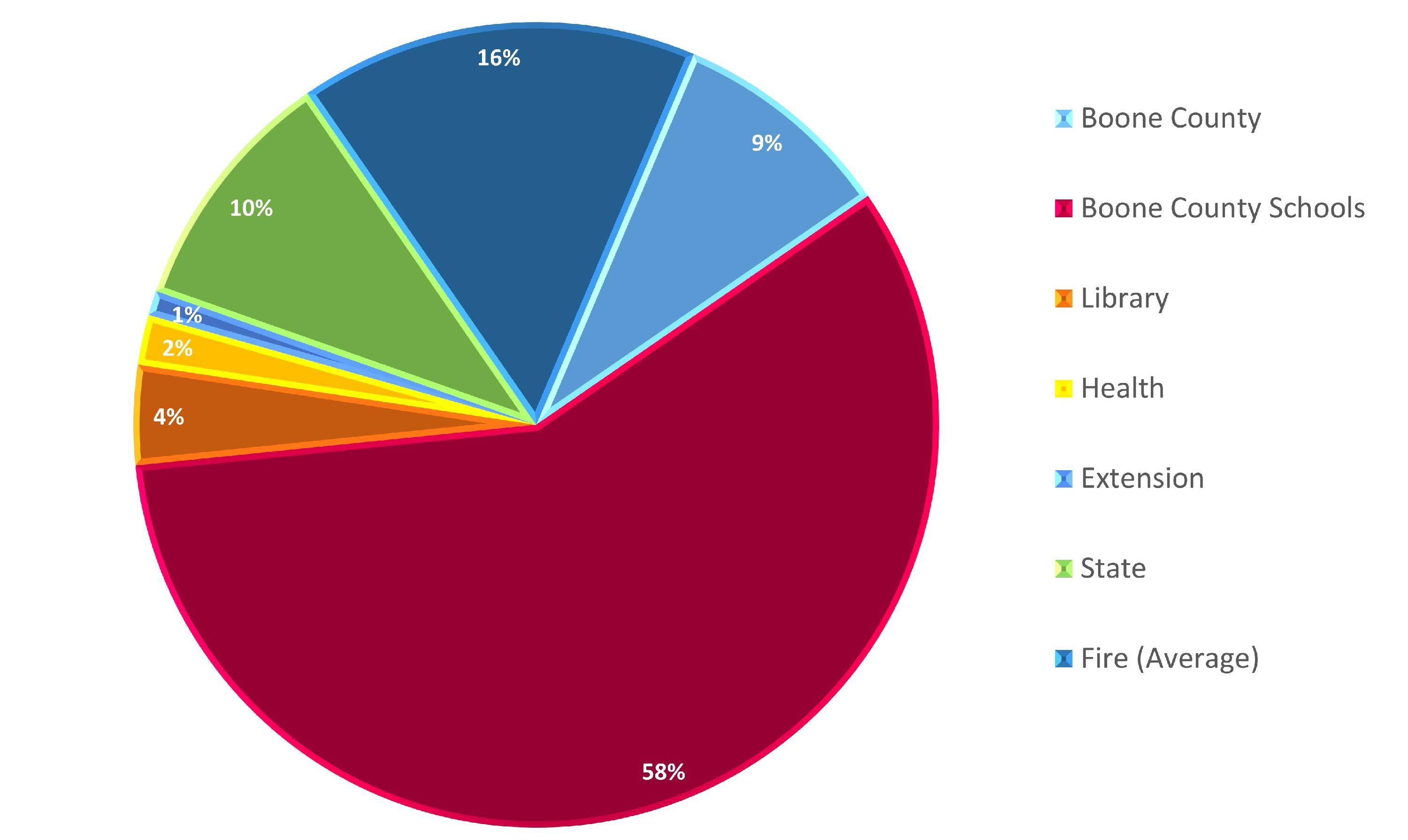

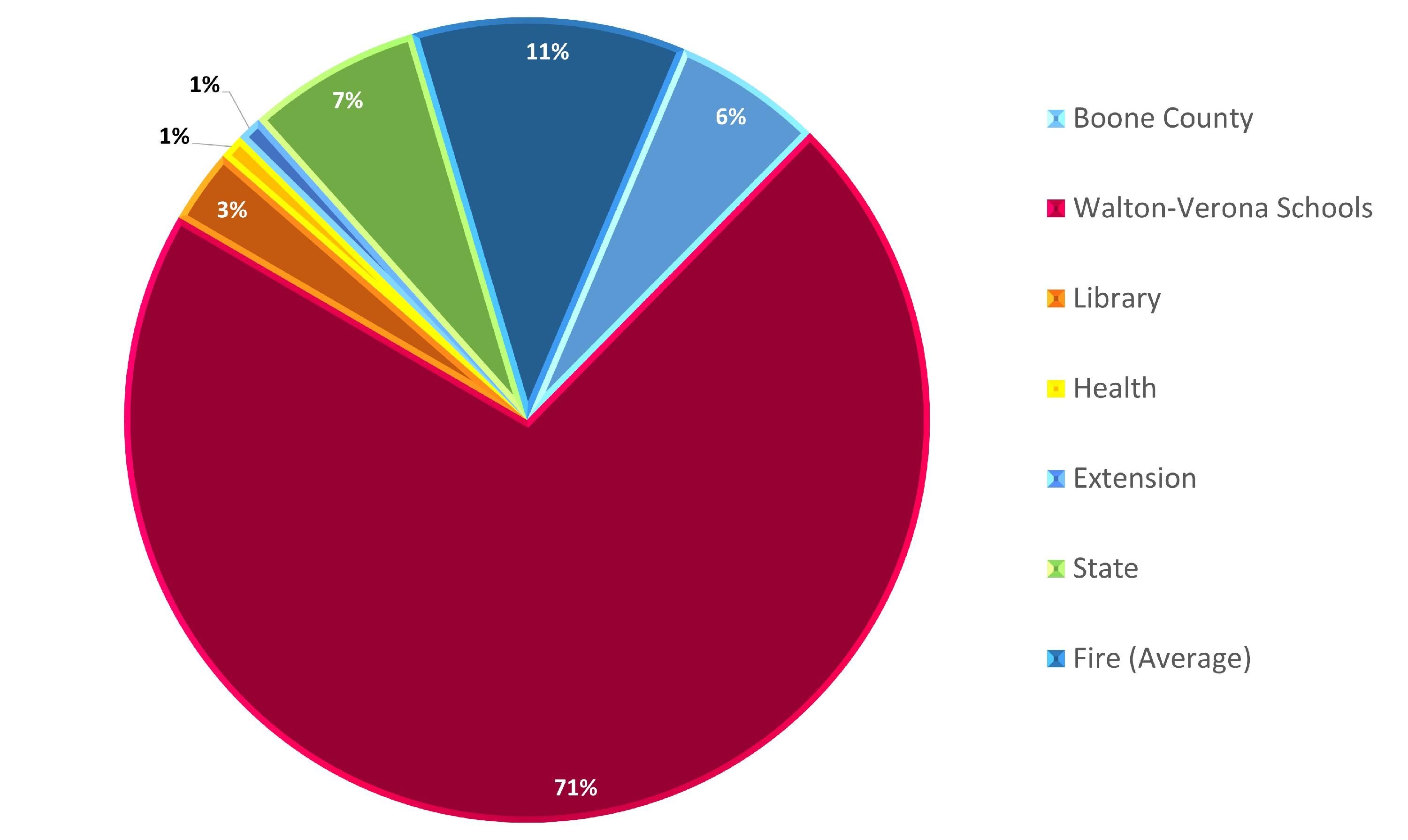

The pie chart below breaks down the percent each taxing district/entity receives from property tax bills.

For those living in the Boone County School District:

For those living in the Walton-Verona School District:

Here’s a brief breakdown of each rate, including who sets it and what it’s used for (in order as they appear on bills).

State

Tax Rate: 0.1140/$100

The State Real Estate tax rate is determined by the Commonwealth of Kentucky. It supports the General Fund, which pays for many statewide services, including education, human services and health care. Income tax and sales tax generate nearly three-fourths of the General Fund. Learn more about the Kentucky State Budget from the Kentucky Center for Economic Policy.

County

Tax Rate: 0.0960/$100

The County tax rate is set by the Fiscal Court, an elected body that includes the Judge/Executive and three County Commissioners. The Fiscal Court recently approved a tax rate decrease for 2023, lowering the County’s tax rate from 0.098 to 0.096. Taxes help fund important projects and services that help improve the lives of residents, ensuring our County has:

- Safe and reliable roadways.

- Law enforcement to serve and protect our residents and communities.

- Robust recreational and sports opportunities for residents of all ages to enjoy.

- Beautiful parks to visit.

- Professional and reliable animal control services, including an animal shelter.

- Services that support a wide range of programs for children, youth and adults.

- Snow and ice removal during inclement weather.

- And much more.

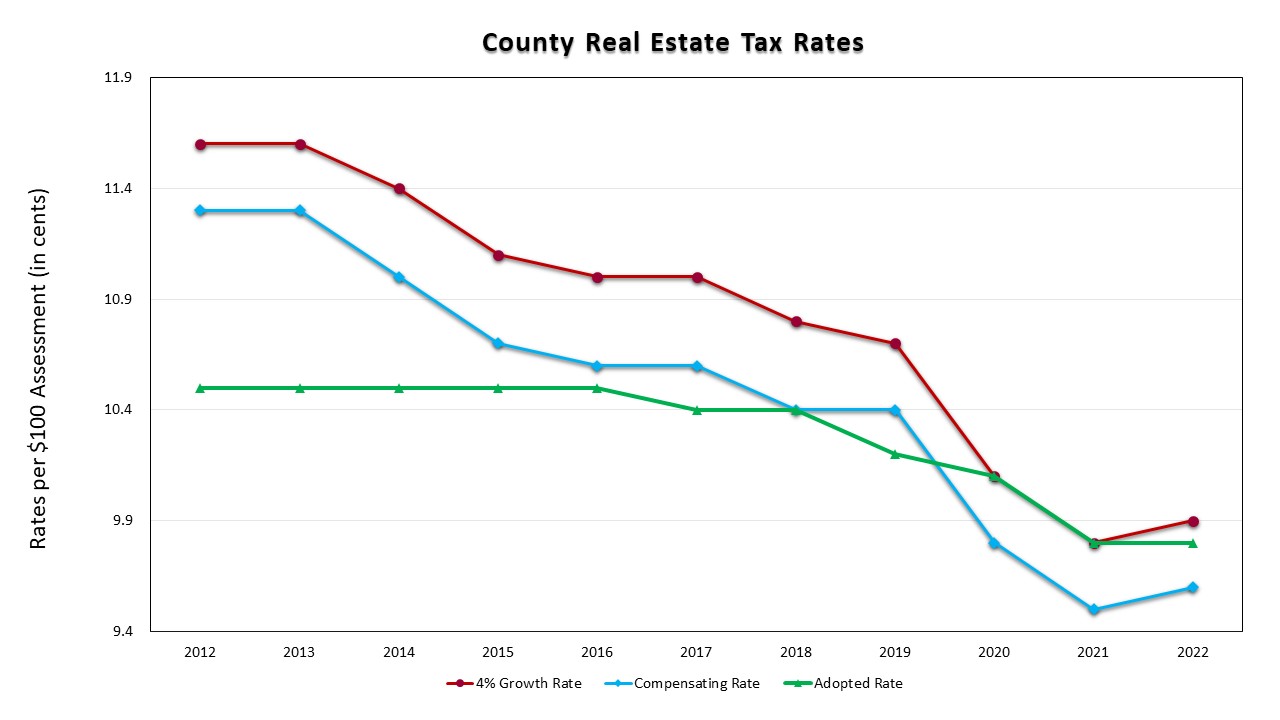

Since 2012, the Fiscal Court has consistently voted to lower or keep property tax rates steady for residents.

School Districts

Boone County School District: 0.6530/$100

Walton Verona School District: 1.1180/$100

Elected officials to the school district boards set tax rates for each year. These rates help generate funds for educational materials, student services and teacher salaries and development.

Extension

Tax Rate: 0.0160/$100

The Boone County Extension District, part of the Kentucky Cooperative Extension, provides educational resources and programs to help build better communities. Funds generated through the extension tax support their programs, including:

- 4-H Development

- Agricultural and Natural Resources

- Family & Consumer Sciences

- Horticulture

- Community Arts

- Community & Economic Development

- Environmental Education

- Nutrition Education Program

- Boone County Farmers Market

Library

Tax Rate: 0.0440/$100

The tax rate for the library is set annually by the Boone County Public Library’s Board of Directors, which includes elected and appointed officials. The Library Board of Directors may not approve a rate that would generate more revenue than the previous year unless approved by the elected Boone County Fiscal Court. Funds generated through tax dollars support important library services, including early childhood development, literacy, collection development and creating free community programming.

Tax Rate: 0.0200/$100

Similar to the Library, the rate for the Boone County health tax is set by the Boone County Health District Board. The tax is used to support community health initiatives, including free cancer screenings, managing infectious diseases and outbreaks, providing free immunizations and many other preventive health services.

Learn more about the Northern Kentucky Health Department.

Fire Districts

- Belleview McVille: 0.2000/$100

- Burlington: 0.1700/$100

- Florence: 0.1500/$100 (unincorporated)

- Hebron: 0.1250/$100

- Petersburg: 0.2000/$100

- Pt. Pleasant: 0.2000/$100

- Union: 0.1950/$100

- Verona: 0.2000/$100

- Walton: 0.1950/$100

911 Fee

Every property owner in Boone County pays $75 each year per occupied dwelling to the County’s emergency dispatch operations. This is a flat amount regardless of the assessed property value. The 911 fee can only be used to support the equipment, technology and personnel who dispatch lifesaving care from local fire districts to our residents. The fee replaced the landline fee that was assessed per line. The 911 fee went into effect in 2018.

Learn more about the 911 service fee.

How Property Is Assessed

The Boone County Property Valuation Administrator (PVA) is a state-run agency that assesses all property in Boone County. The PVA is required to assess properties every three years. Sometimes, homeowners notice an increase in their property tax bill after a new assessment. This is likely because the value of their home (or property) has increased.

Learn more about the Boone County PVA, including how to appeal an assessment or apply for the Homestead Exemption.